Is my car insured? How to check if your car has insurance

Is your car insured? You may think that’s a bit of a silly question, but many people forget their renewal date or need to check a car’s insurance status.

Even if you know the basics, insurance can be a confusing topic, especially when it comes to renewing and switching insurer.

We’ve created this guide to help clear things up. Thankfully, there are a number of ways you can check to see if your car is currently insured…

- How to check your car is insured

- Why check if you’re insured?

- Auto-renewal for car insurance

- Checking your records/files for insurance documents

- How to make sure your car is legally insured

How to check your car is insured

Need to check if your car is insured? Luckily, it’s a very simple process these days and you can check whether your car is insured with a few quick clicks.

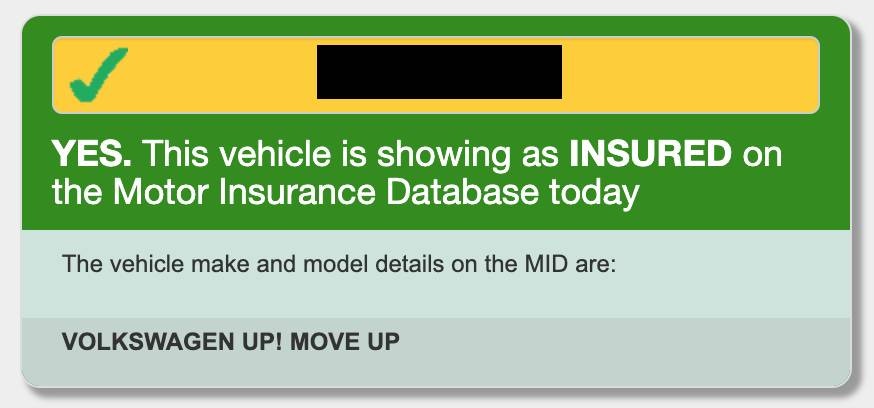

The Motor Insurance Database (MID) has an online search facility. Simply head there and enter your number plate.

Enter your reg at MID to check if your car is insured

It’s a free tool that quickly provides a yes/no answer as to whether or not your car is insured, and it will also confirm the vehicle’s make and model.

If you also want to know who the vehicle is insured with or any other details of the policy attached to your vehicle that will then require a premium search you can instigate here. It will cost £4.

Why check if you’re insured?

For a start, driving without insurance is illegal. Then, of course, there’s the unimaginable situation you could find yourself in if you have to make a claim for your car being stolen, or if it’s involved in a serious accident.

You may have done all the things you think you need to do to keep you and your car legal on the road, but are you one hundred percent sure that everything is in place?

You know you’ve gone through the process, paid the money, and done your bit, but after that, you probably don’t think about it again until you need to renew your insurance, make a claim, or to provide details in order to tax your car.

How can you be sure the companies at the other end have done what they need to do? What if there were a computer glitch and the process of insuring you wasn’t completed? Or what if your renewal date came and went but you forget?

In those and other similar circumstances, there’s a good chance you’re not going to realise anything until it’s too late, and then you’re going to be in quite a mess.

Take a look at the ABI website here, you’ll soon see how much the average UK car insurance claim is, and how much you could be out of pocket if you didn’t have insurance.

Auto-renewal for car insurance

Forgetting to renew isn’t supposed to be a problem anymore, and that’s because of a system called auto-renewal. This is where your current insurer will automatically renew your existing policy unless you instruct them not to.

You can find out more about auto-renewal here, but no system is truly infallible, so it’s still good to know how to check, just to be sure.

Checking your records and files for insurance documents

Another way will require you to do a bit of detective work by searching through your emails or your bank and credit card statements.

Look for payments that appear to be related to car insurance, and you can contact your bank for more details about who the payment is going to so you can contact that company to check your cover.

Your emails should also contain any correspondence you’ve had with insurance companies about car insurance, and hopefully, they will include some sort of confirmation and possibly even a certificate in a PDF or similar type of file.

However, if you’re pretty sure you insured your vehicle but can’t find one of those all-important confirmation emails, remember to take a look in your junk or spam folders.

Making sure you car is legally insured

Even if you have the relevant emails saying you’re insured, it doesn’t hurt to do a MID online search, just to confirm that everything went through as it should and you don’t have to worry about being uninsured.

There’s enough to worry about if you drive these days, but there’s more to car insurance than just getting lower prices so you don’t pay too much.

Not having valid motor insurance could lead to far worse penalties than paying a higher premium than you had to, so it’s good for your peace of mind and security to check that everything is as it should be.

If you’re not aware of what the penalties can be for driving without insurance you can get the lowdown here at the government’s official website.

Ready to sell?

Need to sell your car, or want to understand more about documentation or maintenance? Check out more of our guides here, covering everything from the paperwork you need when buying and selling, to various notices you may need to file with the UK’s driver and vehicle licensing agency.

The information provided on this page is for general informational purposes only and should not be considered as professional advice.